Our experts frequently write blog posts about the findings of the research we are conducting.

BlueVault Partners' Non-Traded REIT Study: Even the Winners do Worse Than Traded REITs

SEC Charges Municipal Issuer with Misleading Investors

FINRA's Conflict of Interest Report

FINRA Files Cease and Desist RE: John Carris Investments and Fibrocell Science

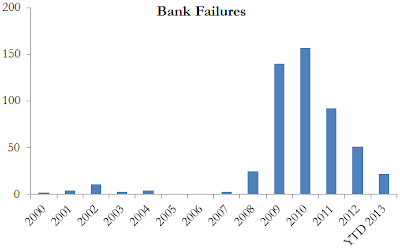

FDIC Goes After Directors of Failed Banks

Illiquid ETFs and SEC Market Maker Incentives

Regulators Soften on Credit Risk Retention Rule

MSRB Proposes Rule on Muni Bond Markups

SEC Halts Texas-Based Forex Trading Scheme

SEC Warns Investors About Binary Options

Much of the binary options market operates through Internet-based trading...