Our experts frequently write blog posts about the findings of the research we are conducting.

SEC Litigation Releases: Week in Review - September 20th, 2013

What is Black-Scholes, Anyway?

FINRA Investor Alert: Private Placements

SEC Cracks Down on Firms for Short Selling Violations

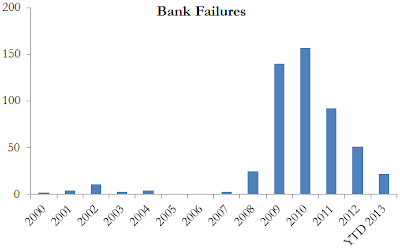

FDIC Goes After Directors of Failed Banks

SLCG Research: Structured Product Based Variable Annuities

SEC Litigation Releases: Week in Review - September 13th, 2013

FINRA Study: Financial Scams Prevalent

SEC Halts Florida-Based Prime Bank Investment Scheme

CFTC: Concept Release on Risk Controls and System Safeguards for Automated Trading