President and CIO of Direxion admits that leveraged ETFs are not appropriate for most investors

(Jan 2012)

Today Seeking Alpha posted an interview with Dan O'Neill, President and CIO of Direxion, one of the first and best known issuers of leveraged ETFs. Readers familiar with our work on leveraged ETFs know that we feel these products are almost always unsuitable for retail investors.

Surprisingly enough, Mr. O'Neill agrees completely:

The leveraged indexed ETFs are used by very tactical investors, and so there we have bull and bear funds. They have daily betas, which means that essentially...

FINRA Regulatory Notice: Complex Products

(Jan 2012)

FINRA recently released Regulatory Notice 12-03: Heightened Supervision of Complex Products, outlining their increased scrutiny of a wide variety of alternative investments including structured products, inverse or leveraged exchange traded funds, and asset-backed securities. Here at SLCG, we've done research on each of those subjects, and have a variety of ongoing projects that bear directly on the issues highlighted by the Notice.

The products identified include:

WSJ on the 'sophisticated investor' defense

(Jan 2012)

The Wall Street Journal's Financial Advisor blog has a new article on the 'sophisticated investor' defense in securities litigation. This defense is typically used by defendants (usually banks or investment houses) in response to claims against them related to suitability of complex investment products. It boils down to the assertion that because a claimant has a high net worth, he or she is capable of understanding and willing to assume the risks of even extraordinarily complex strategies....

Futures-Based (Commodities) ETFs

(Jan 2012)

Investors may think, when investing in Futures-Based Commodities exchange traded funds (ETFs), that they are gaining exposure to the underlying commodity. In this blog post, we discuss the ability of these ETFs to track the spot price of the underlying commodity.

In a previous blog post, we introduced the basics of Exchange Traded Funds (ETFs). In this post, we are going to discuss a specific kind of ETF: Commodities Futures Based ETFs.

There are a large number of Exchange Traded Funds...

NY Times on the Hosier decision

(Jan 2012)

The New York times has an article about the MAT and ASTA products sold by Citigroup that were the subject of a $54.1 million award in Denver last April. SLCG provided expert testimony and analysis for the claimants in this case, including assessing the MAT/ASTA products at issue, and we are excited that the Times has drawn attention to these highly risky investments.

The MAT and ASTA products were hedge funds that implemented a leveraged municipal bond arbitrage strategy. Essentially,...

Structured products: 2011 year-end market review

(Jan 2012)

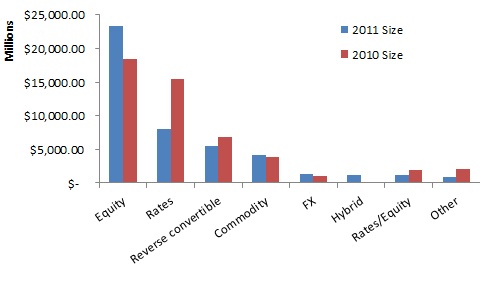

2011 was another big year for structured product sales both in the US and abroad. According to Bloomberg's year end totals, almost $45.5 billion worth of SEC registered structured products were sold in the US in 2011, down only slightly from $49.4 billion in 2010. There were 7,293 individual products sold, up from 6,443 a year earlier.

The number of products linked to interest rates decreased, which was made up for with increases in products linked to equity assets.

Sales in Europe grew...