Major Tenants-in-Common Sponsor Charged with Fraud

(Apr 2013)

Four former executives of DBSI, one of the largest sponsors of tenants-in-common (TIC) interests, have been indicted on 83 counts of securities fraud, wire fraud, mail fraud, and interstate transportation of stolen property. The indictment is seeking approximately $169 million in forfeiture of properties and assets, alleging that the executives misrepresented the financial condition of DBSI to potential investors. The executives named wereformer president Douglas Swenson, general counsel...

Fees on Structured Products Rise as Sales Increase

(Apr 2013)

Kevin Dugan recently reported that fees on structured products linked to stocks have risen to their highest level in three years. In particular Kevin notes that "issuers and underwriters earned $137.7 million in disclosed fees, or 1.95 percent of the $7.08 billion of equity-tied securities" that have a stated commission. Average fees have ranged from less than 1.5% to nearly 2% over the past three years.

The increase in average fees is likely due to the increase in average term for products...

Stockton California May Proceed with Chapter 9 Bankruptcy

(Apr 2013)

Yesterday a federal judge in California ruled that, despite the objections of bondholders and bond insurers, the city of Stockton could proceed in the process of Chapter 9 bankruptcy. Stockton is a city of almost 300,000 located about 90 minutes east of SanFrancisco Stockton was hard hit by the housing bubble and saw a 16% decline (page 345 of the PDF) in general fund revenue from FY 2008-2009 to FY 2009-2010.

After facing "an immediate and severe fiscal crisis" in early 2012, Stockton became...

Barclays' Structured Product Linked to a Basket of ETFs and Indexes

(Mar 2013)

RISK.net recently posted an article entitled "IWM urges investors to think about risk-adjusted returns" in the structured products portion of their website. The article describes in detail a Barclays product for which Institute for WealthManagement, LLC (IWM) served as the basket selection agent. Interestingly, the basket is composed mostly of ETFs, which have been appearing in structured products more frequently as the ETF industry itself has become more mature. IWM's Matt Medeiros talked...

Persistence and Mean Reversion in VIX Rolling Futures Indexes

(Mar 2013)

In our last post we followed up on Jason Voss's discussion of the Hurst exponent as a measure of persistence or mean reversion in market data. We compared the Hurst exponents of the S&P 500 to that of the VIX index, and found that the S&P 500 is largely a random signal (Hurst exponent near 0.5) but that the VIX exhibits characteristics of a 'switching' or mean reverting signal (a Hurst exponent between 0 and 0.5).

Much has been made of VIX mean reversion in the financial blogosphere. One idea...

Securities Lending by ETFs

(Feb 2013)

One of the most contentious but least understood aspects of the stock market is short selling. Short selling refers to selling a stock that you do not own at current market prices, with the hopes that the stock will go down in price. The stock can be purchased in the market at any time to close out the position and, if the stock has decreased in price, the short-seller will realize a profit. Obviously, the only way to accomplish this is by borrowing that stock from someone else.

Typically,...

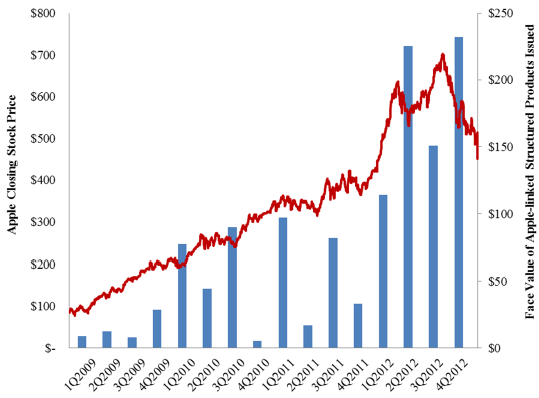

Apple's Declining Stock Price and Structured Products

(Jan 2013)

Jason Zweig at the Wall Street Journal has an excellent piece on a part of the Apple story that hasn't gotten much press: many equity-linked structured products are linked to the common stock of Apple.

SLCG has recently completed an analysis of the market value of outstanding structured products linked to Apple common stock (AAPL). In the following figure, we plot the total quarterly issuance of AAPL-linked structured products in our database since the first quarter of 2009.

As Apple's common...

FINRA Dispute Resolution Statistics 2012

(Jan 2013)

Last week, we covered NERA's analysis of SEC settlements during FY2012. This week, we're taking a look at FINRA's recent release of their dispute resolution summary statistics. FINRA arbitration is a common way for investors to pursue restitution for damage caused by fraud, negligence, or other fiduciary breaches. FINRA provides a detailed summary of the arbitration process and claims can be filed either online or by mail.

Through December of this year, FINRA reports that the number of new...