Mis-sold Interest Rate Hedges

(Feb 2013)

The Financial Services Authority (FSA), Britain's highest financial regulatory agency, has ordered Barclays, HSBC, Lloyds, and Royal Bank of Scotland to review all of their interest rate linked swap agreements sold to small businesses. In an investigation, the FSA found that four banks had violated at least one of its rules in over 90% of the 173 cases reviewed. The London Evening Standard is reporting that seven other banks may also launch similar reviews.

Interest rate swaps -- and related...

SEC Litigation Releases: Week in Review - February 8th, 2013

(Feb 2013)

Steven Harrold Settles SEC Insider Trading Charges

February 6, 2013, (Litigation Release No. 22613)

Afinal judgment was entered against Steven Harrold, former executive at a Coca-Cola bottling company, for his alleged insider trading "based on confidential information he learned on the job" concerning Coca-Cola Enterprises Inc.'s planned acquisition of The Coca-Cola Company's " bottling operations in Norway and Sweden. "The judgment permanently enjoins Harrold from future violations of various...

Call Options on Hedge Funds: Double Markups and Detrimental Mispricing

(Feb 2013)

A recently settled FINRA Arbitration case was brought by an investor who was sold a $2M call option on a basket of hedge funds by a large investment bank. The case was notable for two reasons. First, the investment bank charged a 25 percent markup on the fair value of the option. This large amount was charged even though the investment bank -- call it Investment Bank 1 -- simultaneously laid off all of its risk by buying an equivalent call option from another investment bank -- call it...

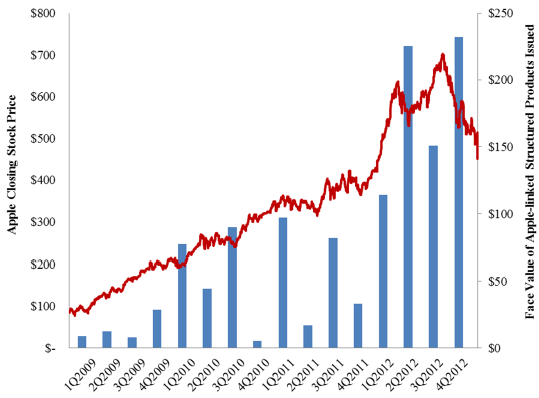

Apple's Declining Stock Price and Structured Products

(Jan 2013)

Jason Zweig at the Wall Street Journal has an excellent piece on a part of the Apple story that hasn't gotten much press: many equity-linked structured products are linked to the common stock of Apple.

SLCG has recently completed an analysis of the market value of outstanding structured products linked to Apple common stock (AAPL). In the following figure, we plot the total quarterly issuance of AAPL-linked structured products in our database since the first quarter of 2009.

As Apple's common...

What a CDO 'Resurgence' Might Mean for Investors

(Jan 2013)

Kaitlin Ugolik at Law360 had an article on Wednesday discussing the recent "bump in demand for collateralized debt obligations." CDOs are complex derivatives that pool assets together and split the risk of that portfolio into tranches which are then sold to investors. CDOs have been implicated in the financial crisis of 2008 and have seen a strong drop-off in new issuances since, though that tide may now be changing.

According to the article, some lenders are predicting a large increase in...

Structured Product Issuers Under Pressure to Disclose Estimated Value

(Jan 2013)

According to securities law firm Morrison & Foerster's Structured Thoughts newsletter, the SEC may soon require issuers of structured products to disclose the estimated value of the product on the front page of the prospectus. From the newsletter:

Elaborating on the [SEC's] sweep letter, the Staff noted that issuers must disclose the "issuer estimated value" on the cover page of the offering document, and share this information with investors prior to the time of sale. This estimated value...

SEC Litigation Releases: Week in Review - January 18th, 2013

(Jan 2013)

SEC Charges Georgia Resident with Insider Trading

January 17, 2013, (Litigation Release No. 22596)

According to the complaint (opens to PDF), John M. Darden III traded with non-public information regarding the merger between Southwest Airlines Company and AirTran Holdings, Inc. Darden, who gained over $150,000 in profits from the illicit trading, agreed to a final judgment that provides permanent injunctive relief and orders him to pay over $325,000 in disgorgement, pre-judgment interest, and...

The Basics of Options Contracts

(Jan 2013)

In a lot of our research work, we break down complex financial products into simpler pieces and then value those simple pieces one at a time. Often, those smaller components are options contracts (especially in our structured product work), which are relatively easy for practitioners to value. However, options contracts use a peculiar terminology that can be confusing to the uninitiated, so we thought we would lay out exactly what we mean when we talk about options.

Options contracts are...