Investors Returning to Capital-at-Risk Products

(May 2013)

Yakob Peterseil of Risk.net recently noted that "[b]anks are boosting issuance of leveraged notes linked to US equity indexes and notes that pay out when yield curves steepen." According to the article, reverse convertibles and buffered notes are seeing a resurgence as investors begin to be more optimistic about stock market growth. In addition, principal-protected structures like structured certificates of deposit and principal-protected notesare falling out of favor as attractive terms are...

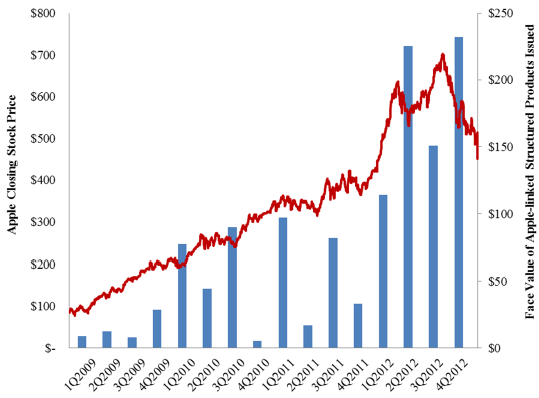

Update on Apple-Linked Structured Products

(May 2013)

A few months ago, SLCG issued a working paper that studied the decline in value of Apple-linked structured products. Jason Zweig of the Wall Street Journal also wrote a piece about these findings, most notably that Apple's stock price decline had serious repercussions in the structured product market. Apple's stock price has continued to fall and we recently updated the paper to show how this decline is still affecting investors in structured products.*

Since reaching $700 in September of...

Are ETF Flows Costly to ETF Investors?

(Apr 2013)

Exchange-traded funds (ETFs) are often lauded for their ability to efficiently create or redeem shares in response to changes in demand for the fund (known as fund flows). However, new research suggests that some ETFs that hold international securities may face transactional frictions that prevent them from tracking their benchmarks as well as other ETFs.

When there is an imbalance between supply and demand for an ETF, authorized participants (APs) create or redeem shares of the ETF to...

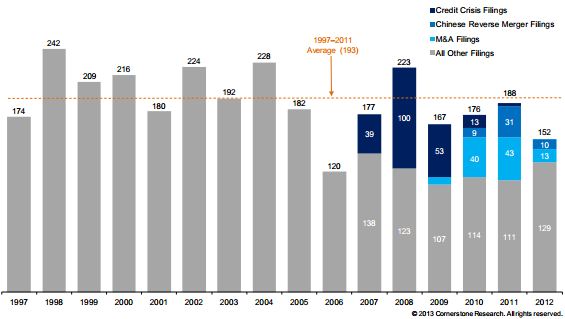

Securities Class Action Filings Decrease in 2012

(Feb 2013)

Earlier this year, Cornerstone Research released 2012 review of Securities Class Action Filings in conjunction with the Stanford Law School -- see the press release. The report notes that the number of federal securities class action filings have decreased in recent years and, in particular, has fallen nearly 20% from 2011 to 2012. For the number of filings over the past sixteen years can be found below (Figure 2 in their report).

Cornerstone attributes the majority of the decline in class...

Apple's Declining Stock Price and Structured Products

(Jan 2013)

Jason Zweig at the Wall Street Journal has an excellent piece on a part of the Apple story that hasn't gotten much press: many equity-linked structured products are linked to the common stock of Apple.

SLCG has recently completed an analysis of the market value of outstanding structured products linked to Apple common stock (AAPL). In the following figure, we plot the total quarterly issuance of AAPL-linked structured products in our database since the first quarter of 2009.

As Apple's common...

The Basics of Options Contracts

(Jan 2013)

In a lot of our research work, we break down complex financial products into simpler pieces and then value those simple pieces one at a time. Often, those smaller components are options contracts (especially in our structured product work), which are relatively easy for practitioners to value. However, options contracts use a peculiar terminology that can be confusing to the uninitiated, so we thought we would lay out exactly what we mean when we talk about options.

Options contracts are...

Structured Products: 2012 Year-End Market Review

(Jan 2013)

Last year, we covered Bloomberg's summary of the 2011 structured product market by noting that almost "$45.5 billion worth of SEC registered structured products were sold in the US in 2011, down only slightly from $49.4 billion in 2010." In 2012, 7,909 notes totaling just over $39 billion worth of SEC registered structured products were sold in the US -- a decrease of nearly 15%.

Interest rate products continued their decline in popularity with a decrease of almost 30% from 2011 to 2012....