The research conducted by SLCG on "How Widespread and Predictable is Stock Broker Misconduct?" revealed that prior customer complaints against individual brokers can be indicative of future complaints. McCann, Qin, and Yan's findings indicate that including the complaint histories of co-workers significantly improves the ability to predict complaints against brokers who have not previously been complained about. They also concluded that customer complaints that were denied - not just settlements and awards - can effectively forecast future investor harm.

Egan, Matvos, and Seru's research underscores that, rather than eliminating underperforming brokers from the industry, the regulatory environment and labor market tend to funnel these brokers towards firms that hire individuals with disproportionately high numbers of customer complaints. These firms typically maintain loose hiring criteria and exhibit lenient compliance standards, specializing in exploiting inexperienced investors.

Dimmock et al. [2016], in a related study, discover that financial fraud exhibits contagious behavior. They reveal that a broker's likelihood of engaging in financial fraud is notably affected by the propensity of their colleagues to commit fraud, even after adjusting for firm culture, branch environment, market conditions, and state regulatory oversight.

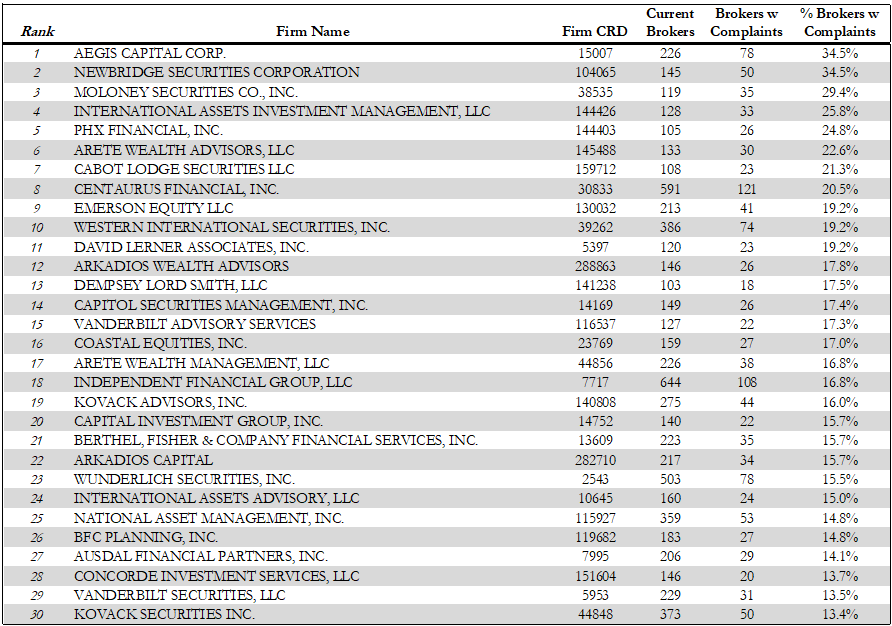

Ted C Bermans current employer,  is one of the 30 highest risk brokerage firms measured by the percent of brokers at the firm who have customer complaints disclosed on their BrokerCheck reports. 14.08% of

is one of the 30 highest risk brokerage firms measured by the percent of brokers at the firm who have customer complaints disclosed on their BrokerCheck reports. 14.08% of  's brokers have customer complaints compared to only 2.71% of all brokers who have complaints.

's brokers have customer complaints compared to only 2.71% of all brokers who have complaints.

If you have questions about this post, about

and/or Ted C Berman or about the management of your accounts, please contact SLCG for an initial consultation or email us at

BrokerInquiry@SLCG.com.

For almost a quarter of a century, SLCG Economic Consulting, LLC ("SLCG") has been delivering consulting services to individuals, businesses, and both state and federal agencies, primarily focusing on finance and economics. The team at SLCG comprises experts with extensive academic and governmental backgrounds who actively engage in research that is often suitable for publication.

SLCG is a wholly owned subsidiary of McCann Yan Holdings, Inc., a Virginia incorporated company based in Northern Virginia.

Reference:

[1] S. Dimmock, W. Gerken, and N. Graham. "Is Fraud Contagious? Co-Worker Influence on Misconduct by Financial Advisors" The Journal of Finance Vol. 73, No. 3 June 2018.

[2] M. Egan, G. Matvos, and A. Seru. "The Market for Financial Adviser Misconduct". Working paper, Journal of Political Economy Volume 127, Number 1, February 2019.

[3] C. McCann, C. Qin and M. Yan. "How Widespread and Predictable is Stock Broker Misconduct?" The Journal of Investing, Volume 26, Issue 2, Summer 2017.

[4] H. Qureshi and J. Sokobin. "Do Investors Have Valuable Information About Brokers?". Working paper, August 2015.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2652535